2026 Product Changes and Benefits

Effective 1 May 2026

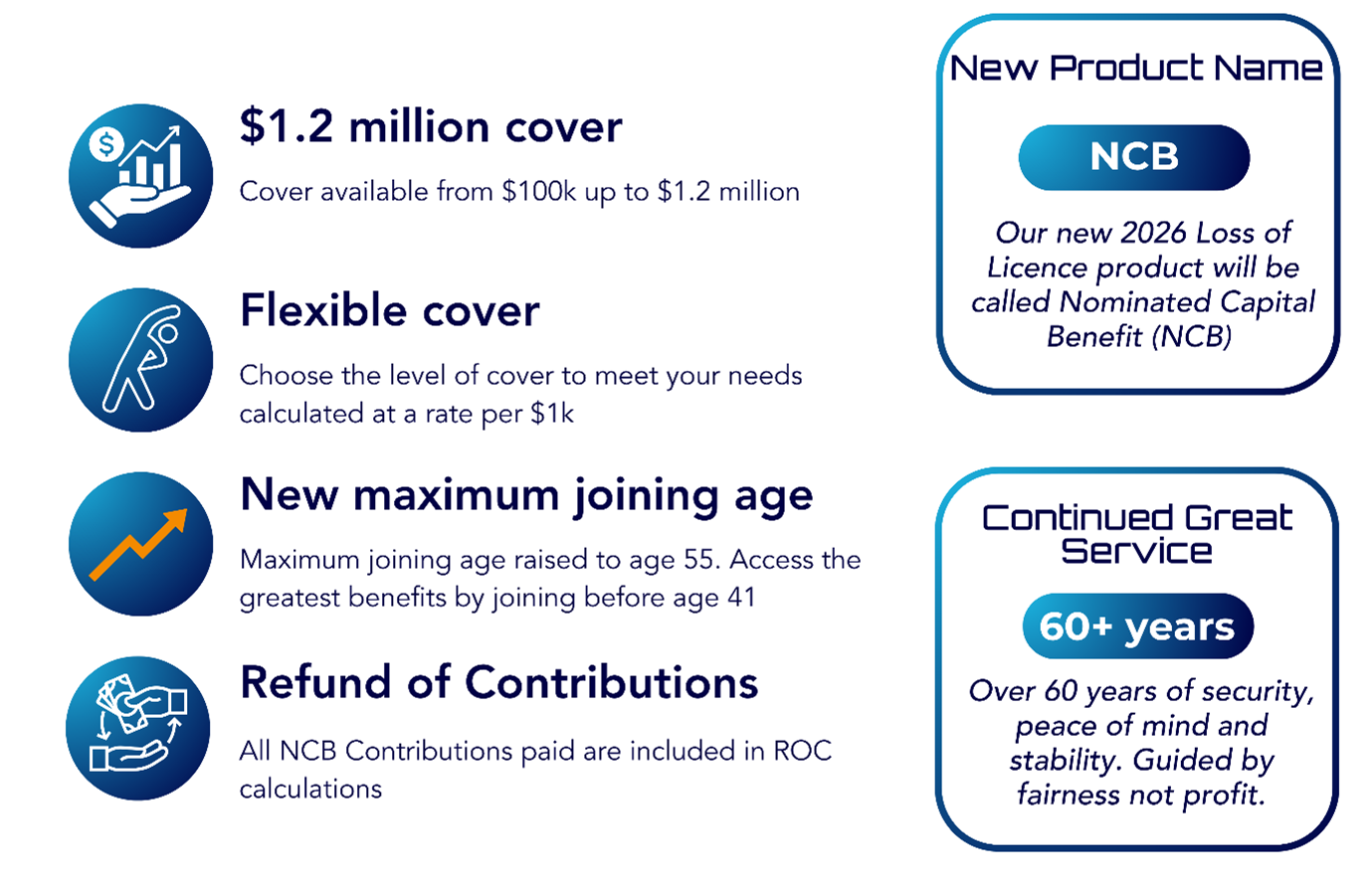

With a membership of more than 3700, in 2025 the Trustees embarked on significant system upgrades and an improved Loss of Licence product – Nominated Capital Benefit (NCB)

From 1 May 2026, MBF are excited to present the following.

$1.2 Million NCB Cover

The maximum NCB cover amount will increase for all members.

If you are aged 18 to 49 years of age, the maximum cover will be $1.2m.

Members can choose a level of NCB from the minimum $100k up to $1.2m (based on age at joining). Calculations are based on a rate per $1k. As with the current product, the available maximum cover begins to decrease from age 50.

SCB/PCB to NCB (Current 2025/26 Members)

The current Standard Capital Benefit (SCB) and Premium Capital Benefit (PCB), based on Joining Bands, will cease at the end of the 2025/26 Fund year (30 April 2026).

The SCB/PCB will be converted to a Nominated Capital Benefit (NCB) which will match the level of cover held effective 30 April 2026.

Changing Benefits Amounts at 2026 Renewal

All current members, regardless of age, will have the opportunity to increase their level of cover up to their new maximum NCB amount. After such time, MBF will revert back to the 2026/27 Rule 4.1.

Base Rates and Loading

The new Contributions and Benefits Scale will be easy to understand.

Base Rates will apply to members who join(ed) the Fund before age 41 with no loading.

Base Rates for 2026/27

| Present Age | Max Cover | Rate per $1000 | Annual Cost | Present Age | Max Cover | Rate per $1000 | Annual Cost | |

|---|---|---|---|---|---|---|---|---|

| 18 | $1,200,000 | $3.15 | $3,780.00 | 42 | $1,200,000 | $4.35 | $5,220.00 | |

| 19 | $1,200,000 | $3.15 | $3,780.00 | 43 | $1,200,000 | $4.40 | $5,280.00 | |

| 20 | $1,200,000 | $3.15 | $3,780.00 | 44 | $1,200,000 | $4.45 | $5,340.00 | |

| 21 | $1,200,000 | $3.15 | $3,780.00 | 45 | $1,200,000 | $4.50 | $5,400.00 | |

| 22 | $1,200,000 | $3.15 | $3,780.00 | 46 | $1,200,000 | $4.65 | $5,580.00 | |

| 23 | $1,200,000 | $3.15 | $3,780.00 | 47 | $1,200,000 | $4.80 | $5,760.00 | |

| 24 | $1,200,000 | $3.15 | $3,780.00 | 48 | $1,200,000 | $4.95 | $5,940.00 | |

| 25 | $1,200,000 | $3.15 | $3,780.00 | 49 | $1,200,000 | $5.20 | $6,240.00 | |

| 26 | $1,200,000 | $3.15 | $3,780.00 | 50 | $1,080,000 | $5.50 | $6,940.00 | |

| 27 | $1,200,000 | $3.20 | $3,840.00 | 51 | $1,080,000 | $5.80 | $6,264.00 | |

| 28 | $1,200,000 | $3.20 | $3,840.00 | 52 | $990,000 | $6.10 | $6,039.00 | |

| 29 | $1,200,000 | $3.20 | $3,840.00 | 53 | $930,000 | $6.40 | $5,952.00 | |

| 30 | $1,200,000 | $3.20 | $3,840.00 | 54 | $930,000 | $6.70 | $6,231.00 | |

| 31 | $1,200,000 | $3.35 | $4,020.00 | 55 | $930,000 | $7.05 | $6,656.50 | |

| 32 | $1,200,000 | $3.38 | $4,056.00 | 56 | $850,000 | $7.35 | $6,247.50 | |

| 33 | $1,200,000 | $3.42 | $4,104.00 | 57 | $850,000 | $7.70 | $6,545.00 | |

| 34 | $1,200,000 | $3.45 | $4,140.00 | 58 | $850,000 | $8.20 | $6,970.00 | |

| 35 | $1,200,000 | $3.50 | $4,200.00 | 59 | $730,000 | $8.70 | $6,351.00 | |

| 36 | $1,200,000 | $3.60 | $4,320.00 | 60 | $640,000 | $9.30 | $5,952.00 | |

| 37 | $1,200,000 | $3.65 | $4,380.00 | 61 | $640,000 | $9.90 | $6,336.00 | |

| 38 | $1,200,000 | $3.70 | $4,440.00 | 62 | $580,000 | $10.60 | $6,148.00 | |

| 39 | $1,200,000 | $3.75 | $4,500.00 | 63 | $580,000 | $11.30 | $6,554.00 | |

| 40 | $1,200,000 | $4.00 | $4,800.00 | 64 | $580,000 | $12.20 | $7,076.00 | |

| 41 | $1,200,000 | $4.20 | $5,040.00 |

Members who join(ed) from age 41 to age 55 will pay a 10.5% percentage loading to the above 'rate per $1000' for each year of joining after age 40.

Example:

Joined at 45 = 5 x 10.5% loading

Joined at 49 = 9 x 10.5% loading

Joined at 54 = 14 x 10.5% loading

Refund of Contributions

Future NCB contributions paid will be included in the Refund of Contributions (ROC) calculations (previously SCB only).

Transitional Rule - Capping of Contribution Increases for current members

Most current Members will benefit from the new single scale NCB.

However, some late joiners, those with complex cover or nearing retirement, may face higher costs for the same amount of cover. To assist, any significant contribution increase will be capped at $250 during transition until 31 May 2026. This is a one-off offer that will not be repeated in future Fund years.

Changing NCB levels and Health Declaration

From 2026, Members will be able to increase their NCB cover at any time throughout the Fund year, offering flexibility to better suit changing circumstances (e.g. family, job changes, employer contributions).

Any increase in NCB will require the completion of a Health Declaration and will be subject to a Zero and/or a Limited Cover Restriction for pre-existing medical conditions declared.

Existing 2025 Product Features

These features were introduced from 1 May 2025 and will apply to the new NCB product as well:

Death Benefit

- $50,000 additional Death Benefit for all Members as the new starting point is $150,000

- Death Benefit increase of $10,000 per year of membership extended to 25 years

- Maximum Death Benefit increased from $300,000 to $400,000 (but not greater than SCB/NCB amount)

Refund of Contributions (ROC)

- Maximum ROC increased to $75,000

New 2025 Benefits

- Trauma Benefit of $100,000 for specified trauma events

- Single Pilot / Multi Crew Benefit to assist with training and re-employment

Monthly Benefits

- Maximum Monthly Benefit increased from $12,000 to $15,000

- Unemployed Monthly Benefit increased from $8,000 to $10,000

Resources

- 2026/27 AAPMBF Fund Rules v3 (PDF)

Note: v2 - At 16 October 2025 MBF Board meeting, the Slip Rule 1.2.6.1 was exercised to amend Rule 3.6.4 (‘from 31 May' to ‘after 31 May') and Rule 4.1.3 (‘after 56’ to ‘from 56').

v3 - At 14 November 2025 MBF Board meeting, the Slip Rule was applied to 8.9.1 to amend from 'NCB' to 'Capital Benefit Balance'. - AFAP Annual Convention presentation with scenarios (PDF)

Contact us

- +61 (0)3 9928 4500

- Email: Member Services